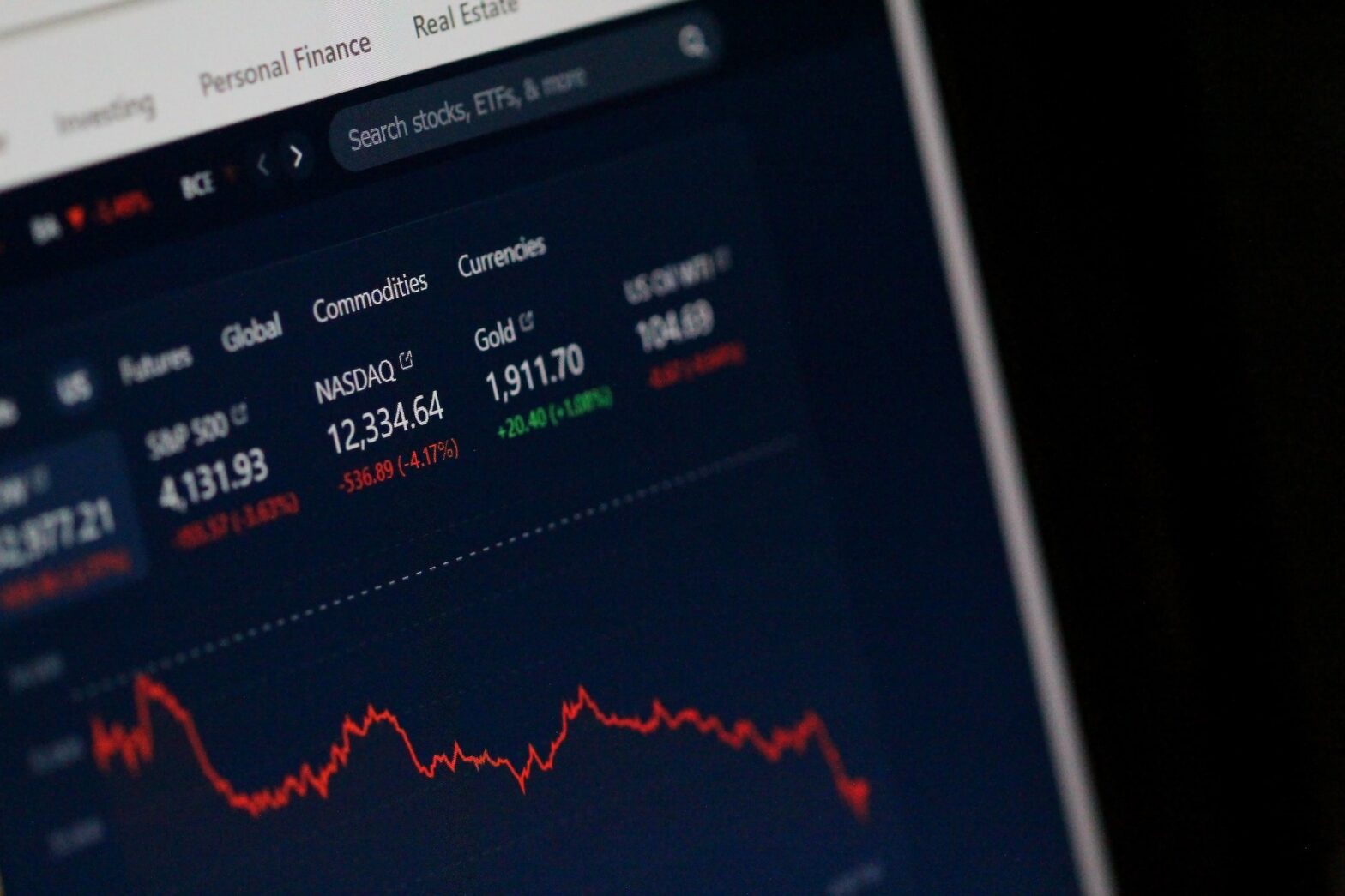

A recession happens when economic growth slows for more than a few months. Its effects can be felt in many ways across most industries. For production, wages, and the stock market, a recession can be a problem. But how does a recession affect private equity? This high-risk, high-return asset class has opportunities and risks when investing during a recession. Understanding what private equity is and why it’s unique may allow you to grow your portfolio even in a recession. In this guide, we go over what you need to know about how a recession affects private equity.

Continue reading “How Does a Recession Affect Private Equity?”Why You Need To Diversify Your Real Estate Investing Portfolio

Real estate investing is a tried-and-true wealth-building strategy that can help you leave a family legacy. However, like all investing, real estate investing carries risk. With the right approach, you can limit your risk when buying stakes in real estate, but you have to know how to diversify your portfolio. Diversifying means investing in multiple sources and using a variety of investing strategies. This guide explains why it’s important to diversify your real estate portfolio and how to do it so you stay profitable in your endeavors.

Continue reading “Why You Need To Diversify Your Real Estate Investing Portfolio”IRR vs ROI in Real Estate Investing

The world of real estate investing has many complexities that can make choosing the right strategy a challenge. Knowing how to evaluate an investment using modern metrics and analytics created specifically for the real estate market allows you to gain valuable information about a property on your radar or in your portfolio. Two metrics investors commonly use to evaluate real estate deals are return on investment (ROI) and internal rate of return (IRR). Let’s go over what these metrics are and how to calculate them so you can better understand their similarities and differences.

Continue reading “IRR vs ROI in Real Estate Investing”Top Plant-Based Restaurants in Boca Raton: Vegan and Vegetarian Dining

Are you tired of the same old dining options and looking to add some plant-based variety to your life? Well, you’re in luck! Boca Raton is a haven for plant-based dining, offering a plethora of restaurants that cater to vegan and vegetarian lifestyles.

Whether you’re a long-time plant-based eater or just curious about trying something new, this guide is for you. So, let’s dive in and explore the top plant-based restaurants in Boca Raton and the surrounding areas!

Continue reading “Top Plant-Based Restaurants in Boca Raton: Vegan and Vegetarian Dining”Investing in Existing Properties vs Ground-Up Construction

Real estate investors are able to capitalize on a variety of investing strategies to grow their wealth. As a real estate investor, you can buy existing properties or build your own structures from the ground up to expand your portfolio. These methods can help you achieve the passive income you desire. Our team at Titan Funding in Boca Raton, Florida, will help you compare the pros and cons of investing in existing properties vs. ground-up construction so you understand the differences between these types of real estate investing strategies.

Continue reading “Investing in Existing Properties vs Ground-Up Construction”Best Markets in Florida for Ground-Up Construction Loans

Real estate investment is an excellent avenue for building wealth because of the various methods available for creating a solid portfolio. Investing in new construction in Florida can boost real estate holdings and profits. A ground-up construction loan allows you to build a structure on land to sell for a profit or rent for passive income. Taking advantage of Florida’s hottest markets for new construction gives you the opportunity to grow your real estate business. Read as our Titan Funding team in Boca Raton, Florida, shares this guide to the best markets in the state for ground-up construction loans.

Continue reading “Best Markets in Florida for Ground-Up Construction Loans”