What is distressed debt investment, and why is it quietly attracting investors at the present time?

Distressed debt purchasing is a high-risk investment strategy but when it pays off, it pays off in spades. Hedge fund managers can generate substantial returns; though, as with any investment, the higher the potential return, the greater the risk. Lenders are not publicizing distressed sales at present, as there is strong motivation in maintaining optimistic perceptions of the market.

Successful distressed debt investment involves purchasing a debt at a substantial discount by purchasing bonds in distressed companies. Opportunities arise when companies are likely to file, or already have filed, for bankruptcy protection. Investors are gambling that the indebted company will eventually recover from bankruptcy as a successful business, resulting in an increase in the value of its bonds and, therefore, enabling vast profits. Additionally, owning company bonds, rather than stock gives the new owners of the debt priority status as a creditor during the bankruptcy process. They may even end up owning the troubled company — if they can then turn the company around, their profits will be greater still. [1]

Clearly this is a high-risk strategy and definitely not for the average investor. Distressed debt investors need to be able to judge the creditworthiness of the indebted company and know just when to purchase the debt, and at how much of a discount to make it worthwhile. There is always the chance that the investors will lose everything if the company does default on the loan.

What, then, can we expect to see in the distressed debt investment market during the current crisis? Markets have been in chaos for the last two months and there are increasing ‘whispers’ of loan sales in process. [2] Shrewd investors will be watching very carefully; so, when, considering the current crisis, can we expect a flood of such loan sales to start?

“…[T]he answer is hopefully never, but there will be some [opportunities] depending on how much relief is given at different types of lending institutions… But unless we see federal bailout dollars come in soon, the non-bank financial institution space — the mortgage REITs and non-bank and CMBS lenders — that’s where you’re going to see this trouble,” says Spencer Levy, CBRE senior economic advisor.

Hedge fund managers are well positioned to invest in the bond market in this way; it’s possible for them to make substantial returns while risking a very small percentage of their overall worth. However, individual investors can also benefit, particularly through mutual funds.

The current pandemic has put considerable pressure on some REITS, causing them to sell off securities and existing loans. In just one example, the New York luxury condo market has already taken a major hit, where buyers are wanting to back out of agreed sales, fearing a large drop in price compared with the price agreed before the effects of Covid-19. [3]

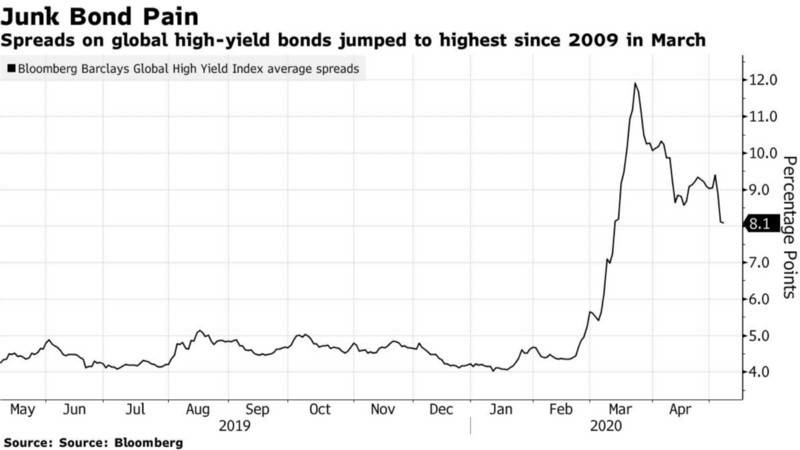

The double whammy of Covid-19 and a sharp decrease in oil prices has caused the threat of the worst recession since the Great Depression, with many companies finding themselves defaulting on their loans. In times of crisis, the slogan “cash is king” is often true; liquidity is key, and some companies will eagerly be hoarding cash in order to position themselves to buy distressed debt at discounts. Some may try to overcome their liquidity problems by either swapping their debt or buying it back at discounts. Moody’s Investors Service forecasts increasing numbers of distressed debt exchanges, [4] a forecast that is supported by historical data.

One company that is hoarding cash, Brookfield Asset Management Inc., currently has more than $60 billion available to weather the current crisis. In Q1 of 2020, Brookfield changed its strategy and started investing in public companies that were trading at a fraction of their normal cost. [5]

CEO Bruce Flatt wrote the following in a letter to Brookfield’s shareholders on May 14:

“In reflecting on what really matters to our business, it is liquidity, liquidity and liquidity, in that order. The most damaging thing for any business owner is to find yourself out of business and unable to participate in the recovery, or in a position of needing to issue shares which dilute the owners, and therefore make it impossible to ever recover from undue dilution at the wrong time… We will continue to add to our liquidity and deploy capital as opportunities arise.”

Writing for Markets Insider, [6] Ben Winck suggests that “several of Wall Street’s biggest firms are raising billions of dollars to pile into distressed debt, viewing the Federal Reserve’s relief measures as a backstop for ailing corporations.”

Time will tell, as the crisis continues, whether we see a sudden surge in distressed debt investment. Currently many companies are adjusting their focus to re-opening; some may be in

the fortunate position of having sufficient capital to weather the storm; sadly, others may not. Similarly, many investors may indeed be hoarding cash or liquidating assets with a view to being ready to strike if companies continue to struggle.

[1] Tim Lemke — The Balance: Distressed Debt Investing and How it Works May 2020 https://www.thebalance.com/distressed-debt-investing-and-how-it-works-4176037

[2] Mack Burke/Cathy Cunningham — Bloomberg: The Distressed Debt Space has Plenty of Interest but the Dam Hasn’t Opened, Yet May 2020 https://commercialobserver.com/2020/05/the-distressed-debt-space-has-plenty-of-interest-but-the-dam-hasnt-opened-yet/

[3] Mack Burke/Cathy Cunningham — Bloomberg: The Distressed Debt Space has Plenty of Interest but the Dam Hasn’t Opened, Yet May 2020 https://commercialobserver.com/2020/05/the-distressed-debt-space-has-plenty-of-interest-but-the-dam-hasnt-opened-yet/

[4] Denise Wee — Bloomberg: ‘Hidden’ Defaults set to Soar as Recession Squeezes Firms May 2020 https://www.bloomberg.com/news/articles/2020-05-10/-hidden-defaults-set-to-soar-as-recession-squeezes-companies

[5] Scott Deveau — Bloomberg: Brookfield is Sitting on $60 Billion to Help Weather the Pandemic May 2020 https://www.bloomberg.com/news/articles/2020-05-14/brookfield-is-sitting-on-60-billion-to-help-weather-pandemic

[6] Ben Winck — Markets Insider: From precious metals to loans on the brink of default: Investors are flocking to these assets after the coronavirus market meltdown April 2020 https://markets.businessinsider.com/news/stocks/investors-buy-gold-bitcoin-distressed-debt-stock-market-recovery-coronavirus-2020-4-1029129787