The private credit market has been a key part of the debt market for decades now, and has grown exponentially since 2008, usefully filling a funding gap for many businesses. In the period from 2000 till June 2019, the private credit sector has grown from $42.2 billion to $795.3 billion [2].

“…[B]usinesses of all sizes across America turn to the private debt market for critical capital for operations and expansion…,” says Drew Maloney, president and chief executive officer of the American Investment Council, writing for Institutional Investor.

Approximately 70% of US businesses lack access to traditional funds through the public debt market, and private debt is instrumental in filling the void, being particularly useful for the myriad small- to medium-sized businesses that help keep the economy buoyant [3]. Private credit is registered by the Securities and Exchange Commission and loans are underwritten carefully, as investors are often risking their own money. Private lenders are likely to be experienced investors who are very familiar with the markets in which they operate. They are usually looking to diversify a small proportion of their portfolios [4]. Most private credit firms keep a careful balance between assets and liabilities, meaning that they should never be forced to sell assets in a crisis. Private credit firms generate sustainable returns with low volatility, making them an attractive prospect for investors.

How private lenders can negotiate the post-COVID era

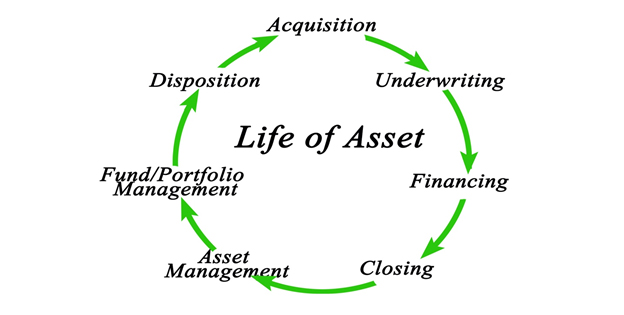

The effects on employment and businesses already felt, as a result of the pandemic, have created an unprecedented level of anxiety and instability; the risk of default and bankruptcies is considerably increased. This uncertainty is impacting the commercial real estate life cycle [5], a situation that is likely to continue in the post-pandemic world. Even as businesses begin to re-open, many may be facing a backlog of expenses, and/or are operating at reduced capacity, and might be unable to make rent payments.

“As more liquid credit markets dry up, private debt is going to be potentially in an advantageous position,” says head of private debt at Preqin, Tom Carr [6].

For private credit firms, liquidity and flexibility are key. Without the constraints that limit lending for the banking industry, private lending firms can move faster, allowing deals to be closed quickly. Investors can also mitigate risk by underwriting their loans. In fact, private debt has historically been shown to perform well during economic downturns. When conventional lending opportunities contract, private lending expands [7].

Benefits of private mortgage lenders during the current real estate market

The real estate market can be difficult to negotiate at this time. Sellers fear declining values will seriously impact their equity and, while they may be able to access short-term assistance from traditional mortgage lenders, this help will likely not continue for too long. Buyers, meanwhile, are hoping to negotiate lower prices. It is also difficult for lenders to estimate collateral levels during this period of uncertainty, when valuations may lack accuracy. To combat this issue, in addition to steps detailed above, private mortgage lenders may choose to place a discount – perhaps as high as 20% – on all pre-pandemic valuations.

That said, private credit firms are still not completely immune to a historically unprecedented crisis such as we are experiencing at present, and some may have needed to pause operations – temporarily or permanently. Those more fortunate may have taken any one of a number of steps to ensure their business remains viable and profitable. Measures may include:

- Price increases

- Reduced loan-to-value thresholds

- Eliminating loans to properties more vulnerable to the downturn, such as those in the retail and hospitality industries

- Increasing interest reserves

- Raising cap rates (Net Operating Income/Value)

- Underwriting loans to mitigate losses and better protect investors

The more successful private credit firms will be flexible enough to adjust quickly to the “new normal,” allowing them to be competitively attractive compared with traditional lenders. Prudent private mortgage lenders will be adjusting their valuation methodologies and their underwriting standards to ensure they have sufficient equity coverage [8].

Private mortgage lenders can help in a number of scenarios where the banks will refuse assistance. For example, short-term bridging loans, more creative loan terms, help for foreign nationals, and solutions for other borrowers with specific needs, can all be met by the private mortgage market [9]. Commercial real estate investments can access private debt to enable them to close deals swiftly, helping to stimulate the economic recovery. Without access to the private credit market, we would undoubtedly see small- to medium-sized businesses fail at a far greater rate.

[1] Funds Europe – June 2020 https://www.funds-europe.com/news/how-will-the-private-credit-sector-fare-in-the-post-covid-era

[2] Funds Europe – June 2020 https://www.funds-europe.com/news/how-will-the-private-credit-sector-fare-in-the-post-covid-era

[3] Drew Maloney, Institutional Investor – February 2020 https://www.institutionalinvestor.com/article/b1k9vk150b1l8t/Private-Credit-Is-a-Driver-Not-a-Drug-of-the-American-Economy

[4] Drew Maloney, Institutional Investor – February 2020 https://www.institutionalinvestor.com/article/b1k9vk150b1l8t/Private-Credit-Is-a-Driver-Not-a-Drug-of-the-American-Economy

[5] Elliot Shirwo, GlobeSt.com – June 2020 https://www.globest.com/2020/06/16/private-lending-steps-up-during-the-pandemic/

[6] Funds Europe – June 2020 https://www.funds-europe.com/news/how-will-the-private-credit-sector-fare-in-the-post-covid-era

[7] Elliot Shirwo, GlobeSt.com – June 2020 https://www.globest.com/2020/06/16/private-lending-steps-up-during-the-pandemic/

[8] Elliot Shirwo, GlobeSt.com – June 2020 https://www.globest.com/2020/06/16/private-lending-steps-up-during-the-pandemic/

[9] Elliot Shirwo, GlobeSt.com – June 2020 https://www.globest.com/2020/06/16/private-lending-steps-up-during-the-pandemic/