Hard money loans are a great solution for investors who need money fast or those who can’t get a more traditional real estate loan. This type of lending provides terms funds that are ideal for investment properties. A hard money loan is typically used short-term. If you’re interested in getting quick access to essential funding for a new real estate project, it’s helpful to know where you can go for a hard money loan. Find out how to locate the best lenders in this category.

Decide if a Hard Money Lender is Right for You

Hard money lenders don’t offer the same terms as traditional real estate loans, but they are the best option in many situations. Hard money lenders will:

- Fund real estate that isn’t eligible for a traditional loan, such as a vacant property in need of repairs.

- Evaluate the value of the real estate more closely than the value of your personal credit score or individual financial situation.

- Require minimal paperwork, making it possible to get a fast approval and closing.

These features make hard money loans a great option if you’re trying to purchase an investment property such as a fix-and-flip. You can close quickly on the loan and beat out other potential investors when you find a great deal. Many lenders will reach a decision on a hard money loan in as little as 48 hours and typically get the funds to you in about four days.

The short terms of a hard money loan work well for projects where you plan to renovate and resell or refinance. Hard money loans are available for amounts ranging from as little as $100,000 to as much as $5 million so you can get the cash you need to fund projects of nearly any scale. Fixed-rate repayment makes it easy to budget as you move forward with your real estate plans.

Alternatives to Hard Money Lenders

Primary alternatives to hard money lenders are banks and private lenders. Banks can offer soft money loans, which are similar in many ways to a hard money loan. However, a soft money loan is typically for long-term financing rather than the short-term solution that you’ll get with a hard money loan. Banks will typically use your creditworthiness as a gauge to determine whether you can get a loan, while a hard money lender looks more at the value of the property and of the project.

Private money lenders are individuals or small organizations that lend money directly to the investor. This is a compelling option, but it’s crucial that you examine the terms of this type of loan carefully. Never accept funds from private money lenders without an explicit contract that details the terms of the arrangement.

How to Find Hard Money Lenders for Real Estate

Reaching out to local resources is often the best way to find a good hard money lender in your area. If you have a real estate agent who’s working with you to help you find the right property for your needs, this individual may also have good leads on hard money lenders. It’s best to work with a real estate agent that specializes in working with investors, as they’ll be more familiar with this type of loan.

Your local real estate investment association (REIA) is another great resource when looking for lenders. There are more than 120 local REIA chapters and associations supporting 40,000 members. Find the location nearest to you and reach out to learn more about becoming a member and accessing their resources. Most chapters meet monthly. Contact information for each one is available online to help you get started.

Hard Money Lenders in Boca Raton, Florida

Simply conducting an online search for local hard money lenders can work wonders, too. It’s important to include your location in the search parameters. Searching for “hard money lenders Florida” will yield nearby results, while simply searching for hard money lenders will give you national listings, many of which will fall outside of your locale.

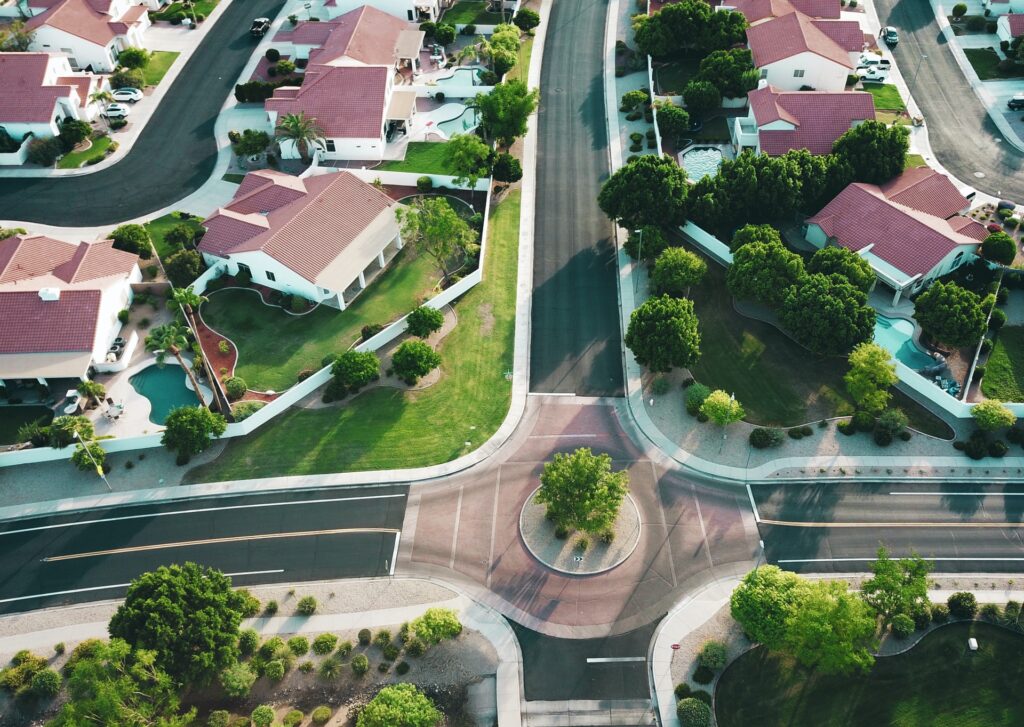

Image via Unsplash by aviosly

Find the Right Hard Money Lender

Once you’ve located some potential hard money lenders, it’s important to compare your options and find the right lender for your personal situation. There are several things that you should consider, including:

- Reputation: Make sure you’re working with a lender who has a good reputation. Look up online reviews and check with those resources mentioned above, such as your real estate agent or other investors in your area.

- Ease of the loan: One of the key selling points for a hard money loan is the ease of use. You shouldn’t have to jump through a lot of hoops or spend months getting your loan in order. Compare the loan approval process and timeline between potential lenders and look for one who works quickly. A hard money lender that takes a lot of time is one with a major red flag.

- Available funds: Determine not only what the property will cost, but also how much your renovations and repairs will be. If you need to secure a loan for more than just the real estate purchase, make sure you can roll this into your hard money loan comfortably.

- Terms: Compare terms between hard money lenders to find competitive interest rates and loan terms. Hard money lenders typically work with terms that are just one to three years.

- Flexibility: Will your lender work with you to help you set up a loan that suits your needs? If the company isn’t willing to discuss the different options for your loan, you may want to consider speaking with another lender.

Every loan is different, so you should expect to review some varying offers as you look for the right fit. The best solution is one that’s tailored to your needs.

While hard money loans are not appropriate for all situations, there are many instances where this type of loan is the perfect fit. Use these tips to find reliable, competitive lenders in your area to help you achieve your real estate goals and manage your money well.