Family offices – wealth management firms catering to ultra-high-net-worth individuals and families – should find real estate debt funds to be an attractive way to increase diversity in their clients’ portfolios. Despite catering initially to niche markets, such as commercial real estate, private real estate lending has blossomed rapidly as an alternative investment in recent years, and looks poised to be a very desirable investment vehicle for high-net-worth investors.

In 2015, the five largest debt funds were responsible for $101.8 billion, or 55% of capital raised in that year. Current analysis from PwC projects an expansion of four, primarily illiquid, asset classes: venture capital, infrastructure, real estate, and private credit, of between $4.2 trillion (worst-case scenario) and $5.5 trillion (best-case scenario) between 2021 and 2025.

Real estate debt funds provide loans, collateralized by real estate assets, for a range of commercial, business, and real-estate development. High returns, make these funds attractive to clients of wealth management firms; with prudent leveraging, risks can also be minimized, offering the “holy grail” sought by investors.

Alternative investments have long had a place in the portfolios of the wealthy; diversification is key, and private lending, collateralized by income-producing real estate, is well deserving of inclusion in any portfolio. The likelihood of post-COVID credit tightening will increase the market for private lenders, who lend to borrowers who might not qualify through more traditional routes, particularly those borrowers looking for bridge finance or construction loans – still rarely available from traditional lenders.

The ultra-wealthy investors – the top 10% in terms of capital invested – have enjoyed a prolonged stretch of gains in recent years. For example, the S&P 500 has increased in value four-fold since 2009 and high-net-worth investors have seen their net worth increase by double-digit percentages over the same period. But COVID-19 has been the catalyst that could change the investment scene. Double-digit returns may not be seen again for a while; nonetheless, most investors should still receive comparatively impressive returns.

“…treasury bonds and government yields are typically used as the benchmark for returns. And with government bonds showing low yields in the US, and even negative yields in some cases in Europe, the ability to produce high single-digit returns should remain attractive.”

– Craig Solomon, CEO, Square Mile Capital.

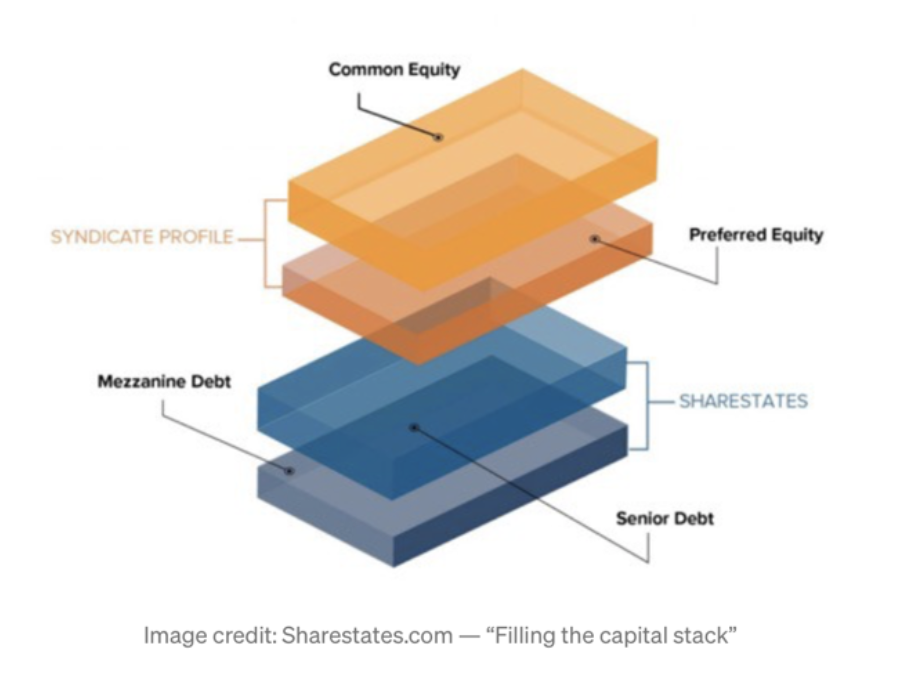

Debt investment is prioritized over equity investments within the capital stack; senior debt has the primary right of return – it must be paid before equity investors receive anything.

Real estate debt funds will certainly face challenges in the post-COVID economy, but with challenges, there are also opportunities.

Challenges include:

- Ensuring sufficient liquidity; wealth management firms should avoid over-leveraging and be able to deal with the challenge of occasional loan defaults.

- Diversifying to avoid overly high exposure to risk.

Opportunities include:

- Excellent chances, for those that have managed leverage prudently, to increase market share when real estate settles into the ‘new normal’.

- The ability to offer loans with more conservative loan-to-value ratios for high-quality real estate projects.

While private lending still accounts for a relatively small percentage of the overall real estate debt market, opportunities for growth remain optimistic.

Liquidity vs Illiquidity

Illiquid investments – of which real estate is a prime example – attract higher rates of return than those with high liquidity. Basically, investors are rewarded for tying up their money for prolonged periods. Conversely, it makes sense that investments with high liquidity attract lower rates. Both scenarios have their pros and cons. Pension funds, for example, are generally happy to invest in illiquid products as they have the necessary time to reap the higher rewards. Nonetheless, there are many benefits to having greater liquidity, particularly in the post-COVID economy where ready access to cash may be very important to some investors.

The ideal solution, of course, is to get the best of both worlds – higher liquidity, accompanied by premium rates that are normally only achieved by non-liquid products. Savvy fund managers may be able to obtain this “best of both worlds” for their clients using open-ended funds. Operating more like mutual funds, open-ended funds offer high liquidity, on an investment vehicle that still attracts the illiquidity premium, in terms of ROI, of an illiquid asset.

Part of the increasing appeal of alternative investments for family offices is due to the alternative strategies that fund managers can use, attracting the illiquidity premiums while also maintaining reasonable levels of liquidity in their clients’ portfolios – a win-win. Similarly, diversified portfolios should provide a balance of high return/high risk and low return/low risk investments.

Real estate debt funds, with their potential for both high returns, and the possibility of higher liquidity, should indeed be of considerable interest to those family office investors servicing high-net-worth individuals.

Sources:

https://www.sharestates.com/blog/2020/03/10/filling-the-capital-stack-how-real-estate-debt-funds-compete-for-investors/ March 2020 – Allen Shayanfekr

https://www.pwc.com/gx/en/news-room/press-releases/2021/prime-time-private-markets.html January 2021 – PwC