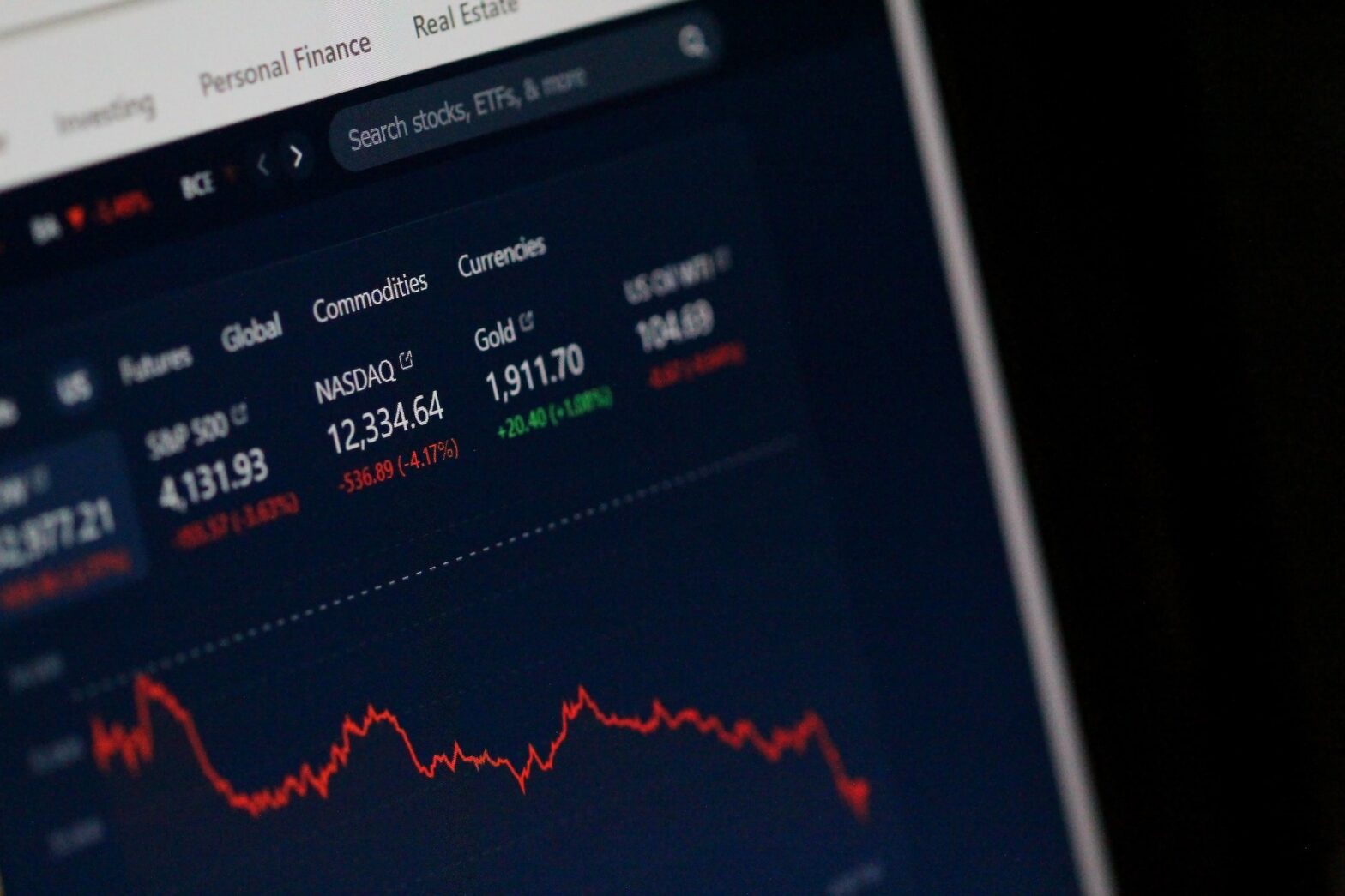

A recession happens when economic growth slows for more than a few months. Its effects can be felt in many ways across most industries. For production, wages, and the stock market, a recession can be a problem. But how does a recession affect private equity? This high-risk, high-return asset class has opportunities and risks when investing during a recession. Understanding what private equity is and why it’s unique may allow you to grow your portfolio even in a recession. In this guide, we go over what you need to know about how a recession affects private equity.

What Is Private Equity?

Private equity is money invested in private, often mature, companies that show growth potential. This type of investment is typically only available to institutional investors and those with high net worth. By acquiring shares in companies or entire companies, private equity funds aim to improve the companies, make them profitable, and sell them for gains. The money invested in a private equity fund is usually tied up in the deal for years, but you may receive payouts sooner depending on the company and the deal.

Investing in a private equity fund gives investors more leverage because they’re pooling their money with other investors who share their goals. The first publicly traded private equity firm was launched in 2007, and several others have joined the stock exchange since. The popularity of this investment strategy is growing, so it’s good to understand how private equity might affect your portfolio with the current economic situation cooling. Although private equity tends to do better when interest rates are low, you can find opportunities in a recession to make this asset class work for you with the right investment strategy.

Challenges With Private Equity During Recessions

Every type of investing has its challenges, especially during a recession, and private equity is no different. The risks of investing are inherent, but private equity comes with a higher level of risk due to its volatility. Buying private companies and turning them around can be quite lucrative. However, in a recession, private equity funds can easily overextend themselves, leaving little to weather the storm if the recession lasts longer than anticipated. Some companies may not be able to withstand the trials of a recession, which is bad news for private equity firms invested in those companies.

Investors in private equity funds could lose their entire investment if a company fails during a recession, and multiple companies in the portfolio struggling could lead to a loss of capital. In most cases, private equity is a long-term investment strategy that requires a forward-thinking investor. A recession, though, can hit unexpectedly, leaving your money vulnerable. To ensure you make the right investments and limit your losses during a recession, research any investment you plan to make and understand the profit and loss potential before you commit.

Opportunities With Private Equity in Recessions

While past performance isn’t indicative of future results, private equity firms have historically done well during the period following a recession. The right private equity fund manager leverages funds to limit losses during a market downturn while also setting the fund up for huge potential gains when markets are on the rise. It’s possible to purchase companies struggling to make it through a recession at a low price, helping expand and grow a portfolio. As long as these companies can secure the right influx of capital, the private equity fund could see a profit in the long term.

Because banks often limit the money they give to businesses during periods of high inflation and high interest rates, a private equity firm with the right amount of capital and leverage can benefit. By investing in companies when a bank won’t, private equity firms may provide the boost needed for them to get through the downturn and thrive when the recession is over. Additionally, a company that can survive a recession looks better to potential buyers when the market turns bullish. Of course, private equity investors need to be efficient during a recession to ensure they meet their financial goals.

Tips for Private Equity During Downturns

With the right investment strategy, you can make money regardless of how the economy is doing. Private equity can be used to your advantage during a recession if you understand how to evaluate a business to determine its potential. Consider using the tips below to potentially help you safeguard your private equity during market downturns.

Use Data and Analytics

AI-generated data and analytics can be a game changer for a private investing strategy. Using the tools available to you to discover information about a business may help you get a better picture of its profit potential. Analytics provide a quick picture of a business’s financial overview, customer base, and market share so it’s obvious where to make improvements.

Get Help With Administrative Tasks

Using AI technology to help automate administrative tasks is another way to make private equity investing more streamlined and efficient. When fund managers can focus on making wise investments instead of paperwork and day-to-day communication, they can increase the amount of profitable assets in the private equity fund.

Diversify Investments

Having a variety of investments in a private equity fund can help spread losses out across a wider range of industries and sectors. For example, a healthy private investment fund should include businesses in industries such as manufacturing, service, and technology. This way, if one sector experiences a harder economic hit than another, it won’t have such a detrimental effect on stakeholder portfolios.

Ready To Invest in Private Equity?

Recessions can be tough on your investment portfolio, but being adaptable and looking to the future can help you make it through any economic challenges. Knowing your investment goals and sticking with them even in hard times can help you achieve wealth in your retirement years. To work with a financial mentor who can help you understand your investment options during bullish and bearish markets, contact our team at Titan Funding in Boca Raton, Florida. We have the knowledge and experience to help you take your portfolio to the next level.

a close-up of a screen by Anne Nygård is licensed with Unsplash License