In the constantly changing field of investment prospects, real estate has long been seen as a sign of stability and capital formation.

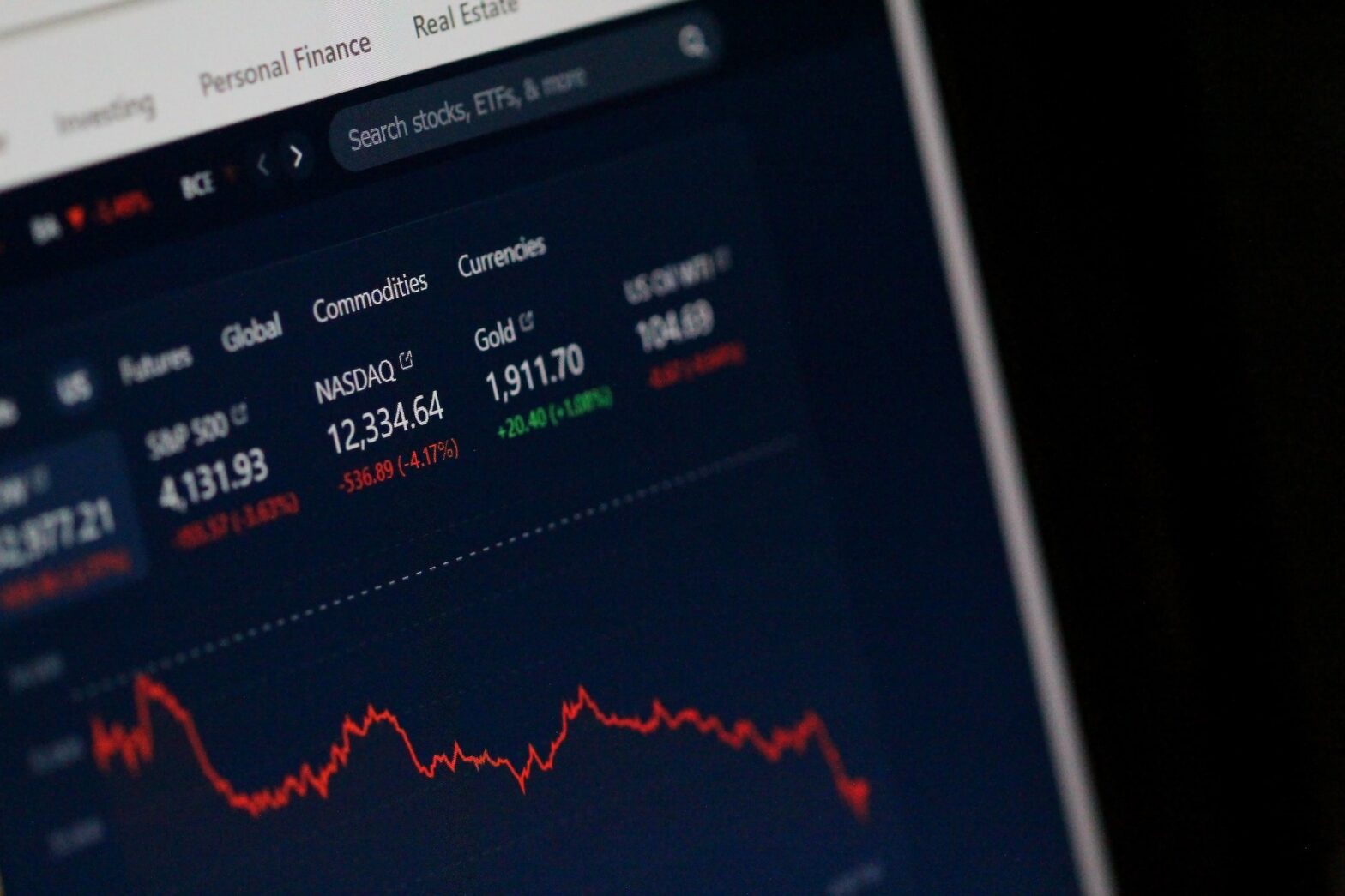

According to U.S. News last October 31, 2023, home prices increased by 2.6% on an annual basis as reported in August 2023. It is also stated that there has been a nationwide increase in prices by 5.8% since the beginning of the year. Noting that there is a current wave of rising home prices, the appeal of real estate investments like private mortgage note investing, remains resilient. This hike may not just be a passing trend but a potential opportunity for investors to start their venture in real estate.

Rather than seeing it as a hindrance to one’s entry into real estate investments, these rising prices indicate the market demand for the subject at hand. The upward trajectory of the prices reflects the interest of the market in proprietorship—a strong link to the growing population and scarcity of housing supplies. As seen by these rising prices, the real estate industry can generate income and capital appreciation. Learn more about real estate investment.

Purchasing mortgage notes secured by real estate allows investors to lend money without actually owning any properties, all the while lowering the risks of maintenance and vacancy expenses. It also guarantees consistent financial flow since monthly interest payments are made to investors. This provides a dependable passive income stream free from the burden of property management. This investment choice makes it adaptable and easily accessible for those who want to establish their position in the real estate sphere. Comparatively speaking, it needs less management and upfront money than outright property ownership because, in this type of investment, investors can select from a range of choices based on their objectives and risk tolerance. These risks are reduced because private mortgage notes are secured by real estate. Investors can protect their investment by taking possession of the property through foreclosure if borrowers fall short on their end. It is undeniably a delight for an investor to have little to no risk in an investment, right?

All things considered, the continued rise in home prices presents a compelling opportunity for investors to explore real estate investments, including niche strategies like private mortgage note investing. Far from being an inhibition, escalating prices reflect the underlying strength and resilience of the real estate market. Investors can successfully manage the current market dynamics and position themselves for long-term financial success by utilizing the advantages of private mortgage note investing. Explore all that at a low cost with Titan Funding!

Reference:

Smart, T. (2023, October). Home Prices Continue to Rise, Edging Up 2.6% Annually in August. https://www.usnews.com/news/economy/articles/2023-10-31/home-prices-continue-to-rise-edging-up-2-6-annually-in-august).