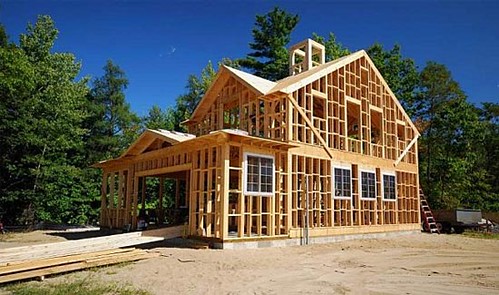

You’ve decided that homeownership is for you but haven’t been able to find anything on the market that you like or that fits your needs. Perhaps you should consider building the home of your dreams but aren’t sure how to finance it. Banks and other financial institutions may have a construction or self-build loan option available for you to make your dream a reality.

What Is a Construction Loan?

When you request a construction or self-build loan, you’re asking to take out a loan on a home or real estate project that has yet to be completed. You will base the mortgage on the project’s cost, including materials and labor, as part of a construction loan. Construction loans are short-term loans that cover the project until you can attain a long-term financing option. Financial institutions consider these types of loans to be high risk, so you’ll typically find higher interest rates on construction loans than a traditional mortgage loan.

How Does a Construction Loan Work?

Either the building company or homeowner can take out a construction loan to custom-build the home of your dreams, including the land, materials, labor, and any required permits. When the homeowner requests the loan, the financial institution may directly pay the funds to the contractor or building company instead of providing those funds to the borrower. Those payments will also likely be made as installments as each phase of the building project is completed. You can also take out a construction loan to restore or rehabilitate a property.

A construction loan is a short-term loan, typically for no longer than one year. Once the home is finished, the borrower will need to decide between refinancing the construction loan into a conventional mortgage or obtaining a new loan to pay it off. This new loan is often called an end loan.

What Are the Requirements for a Construction Loan?

Financial institutions often require a minimum of 20% for a down payment on a construction loan, but that amount may also be as high as 25%. As a result, borrowers with a limited or poor credit history may have a more difficult time obtaining a construction loan. Due to the lack of collateral, you may also encounter challenges in gaining approval for a construction loan because the house has not yet been built.

It’s imperative to provide any potential lenders with a comprehensive list of the construction details, including materials and labor costs. This list is often referred to as the “blue book” and is used to prove to lenders that a qualified contractor or building company is involved in constructing your home. Another vital piece of information you’ll need to provide the lender with is a construction timeline.

You may wish to use a local bank or credit union as they’ll be more familiar with the housing market in your area. In addition, knowing more about the housing market may make them more comfortable in providing you with a construction loan as a member of the community.

Can You Get a Construction Loan for a Home You Plan to Build Yourself?

If you’re planning to be the general contractor of your home build, it’s less likely that you’ll qualify for a construction loan through a financial institution. Instead, you may need to consider an owner-build construction loan. These types of loans are challenging to be eligible for because lenders prefer to know that a knowledgeable, trained professional is involved in constructing a home that they’re providing upfront financing to build.

As the general contractor on your home build, you’ll need to provide a well-researched construction plan that demonstrates your home-building abilities and knowledge. You will use this plan to convince a potential lender that your home build will be successful. Another aspect you may want to consider adding is a contingency plan for unexpected expenses or surprises.

Construction Loan Expectations

During the process of building your home, you can expect that the lender will have an appraiser or inspector out to the build to inspect and approve the various construction phases. After approval, the lender will authorize payment to the building company or contractor. While your home is being built, you can expect to pay the interest only on your construction loan. Construction loans are often paid in stages, unlike personal loans or traditional mortgages. You’re typically only expected to make payments on the interest for the funds currently paid out, not anticipated funds.

Even though the home is not built, you still need a prepaid homeowners insurance policy, including the builder’s risk coverage. Homeowners insurance will protect you if something happens to the home during the construction phase, such as vandalism or fire. Your lender will likely require you to carry this type of insurance to help protect their investment.

Qualifying for a Construction Loan

When applying for a construction loan, you can expect the lender to thoroughly look into your financial situation, even more closely than with a traditional mortgage loan. Be sure to consider the following:

- Credit history. Review your credit report to check for errors and to gauge your credit score. You will likely need a minimum credit score of 700 or higher to qualify for a construction loan. If your credit score is too low, you’ll want to work on bringing your score up before applying.

- Debt-to-income ratio. You’ll want to have a debt-to-income ratio below 40%, so take a look at any debts you could pay down, such as car loans, student loans, and credit cards.

- Down payment. Be prepared to pay between 20 and 25% for a down payment for your construction loan. Have that money on hand so you can ensure the lender that you’re prepared with the down payment.

If you’re considering a construction loan for home improvements or renovations, another option to consider is a hard money loan. The team at Titan Funding can help you decide which loan is best for you and your home project. You can reach us via our secure online messaging system or at 855-929-1134, where a knowledgeable team member would be happy to answer any questions you may have.