Contrary to expectations, it’s certainly not all doom and gloom for investors in commercial real estate. Understandably, three of the hardest hit areas in the pandemic have been the hospitality industry, retail, and office buildings, which still remain largely empty as remote working continues.

Commercial Real Estate Market Remains Robust Despite Vacant Hotel Rooms, Empty Offices, and Struggling Retail

These three things should be causing red flags for potential investors in commercial real estate. However, this has not proven to be the case; despite low occupancy rates for hotels and office buildings, and declining customer numbers in bricks and mortar stores, the US commercial real estate market remains robust. In fact, many institutional investors are currently increasing their portfolio allocation for this sector of real estate.

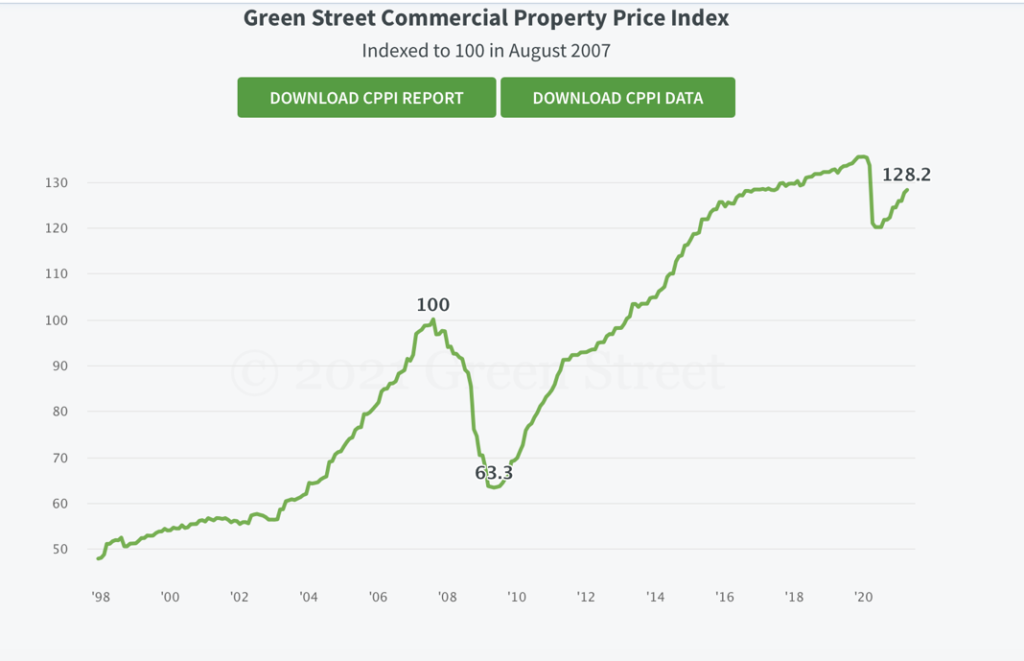

The Green Street Commercial Property Price Index shows that industrial prices rose 5% in April and 10% YTD. Certain areas – industrial, self-storage units, and properties with long leases – are currently well above pre-pandemic levels while lodging and retail properties are still somewhat lower. That said, landlords in these sectors have been somewhat protected by support from the federal government. Prices of commercial property overall did indeed fall by 11% early in the pandemic but, since July 2020, these same properties have seen a 7% rise, showing a very promising recovery, particularly when compared to the 2008 crash, where values fell far more steeply and recovery was much slower1 (Wall Street Journal, Konrad Putzier, May 18, 2021)

Chart credit: Green Street

What is the outlook for commercial real estate in 2021 and beyond?

For the office buildings segment the future is difficult to predict; according to a report by PwC, many employees remain hesitant about returning to the office. While some miss the face-to-face interactions, others enjoy the convenience of remote working. A survey by PwC Canada showed no real consensus with 34% wanting to continue to work remotely, 37% wanting to return to the office, and 29% wanting a combination of both, preferably with a 50/50 split. However, while remote working has so far been surprisingly productive, this may not prove to be sustainable. Many employers want to see their staff return to the office as soon as possible.

Despite the continuing trend towards e-commerce, the retail segment should begin to see a recovery as economies reopen. When employees start returning to downtown offices, this should also lead to increased foot traffic in shopping malls, further helping their recovery.

The hospitality industry can likewise anticipate a far better season in the summer of 2021 and beyond when the lifting of travel restrictions allows frustrated travelers to book vacations again and business travel recommences to facilitate in-person meetings.2

Commercial real estate is an alternative asset class that can be highly rewarding, with relatively low risk, notwithstanding global pandemics. Income potential is high and – unlike residential real estate – landlord responsibility does not tend to be 24/7 and tenants are reliable, often with long leases in place. While COVID-19 has obviously affected some areas of commercial real estate negatively, the effects, as aforementioned, have not been anywhere near as disastrous as might have been predicted and recovery is happening much faster than it did following the 2008 crash. At the same time, other areas are performing far better now than they did before the pandemic, particularly warehouses, self-storage, medical offices, and other commercial properties that have stable tenants in place. Additionally, acquiring commercial real estate tends to be easier, compared with residential properties; industrial properties are not attracting the same level of competition amongst buyers that we are currently seeing in the residential sector. Turnover of tenants is also lower than in residential properties and any depreciation can be offset by tax deductions.

There are definitely investors out there looking for safe investments with the potential for high returns. Those who have been fortunate enough to remain employed throughout the pandemic, often working from home, tend to be higher earners; travel restrictions, combined with savings on commuting and dining out, have meant they now have money to spare and are looking for something other than traditional stocks and bonds to invest in. The current success of the stock market has a flipside; prices are high, making real estate a far more attractive investment that also increases diversity and provides an excellent hedge against inflation. Large pension funds globally are increasing their allocation of alternative investments such as commercial properties to 20 percent, or more. Recovery from losses due to the pandemic is proving to be far faster than recovery from the 2008 crash and looks set to continue as economies reopen. The commercial real estate market remains robust and is poised to make further gains as the nation continues its economic recovery.

- Wall Street Journal, Konrad Putzier, May 18, 2021

- https://www.wsj.com/articles/investors-bet-on-commercial-real-estate-undeterred-by-empty-offices-and-hotel-rooms-11621330204