Seldom do we experience a specific event that creates a paradigm shift in our view of the investment world. The coronavirus pandemic will undoubtedly go down in history as the second such experience in the last 13 years. This is due to its wide-reaching effects upon individuals, the global supply chain and the entire economic scene. However, at some point the curve will flatten, new cases will become fewer and a vaccine will be created. At this point, the light at the end of the tunnel will become visible. But what does this mean for the real estate sector for the remainder of 2020 – and beyond?

The answer to this question depends on so many variables that investment advisors would need a crystal ball to answer with accuracy. That said, many financial experts have published predictions, both short and long term. Long-term outlooks are generally optimistic; as a long-term investment, real estate has consistently proven its worth. Those with no urgent need to sell, homeowners who have a secure enough income flowto service their mortgages, and landlords whose tenants are able to continue paying rent will likely see little effect on their investment in the medium to long term.

Short-term predictions depend on how quickly the economy recovers following ‘re-opening,’ and what relief governments are offering for people who have lost their jobs, for mortgage payment relief, and for the support of small businesses. More than three-quarters of states have currently prohibited evictions and some major lenders have offered deferred mortgage payments. Indications are that the Federal Reserve is ready to do ‘whatever it takes’ to stimulate the economy and the federal government has promised a $2.8 trillion package in loans, fiscal stabilizers and tax deferments. [1] The personal financial situations being experienced by potential investors and home buyers will obviously be a major factor in the outlook for the immediate future.

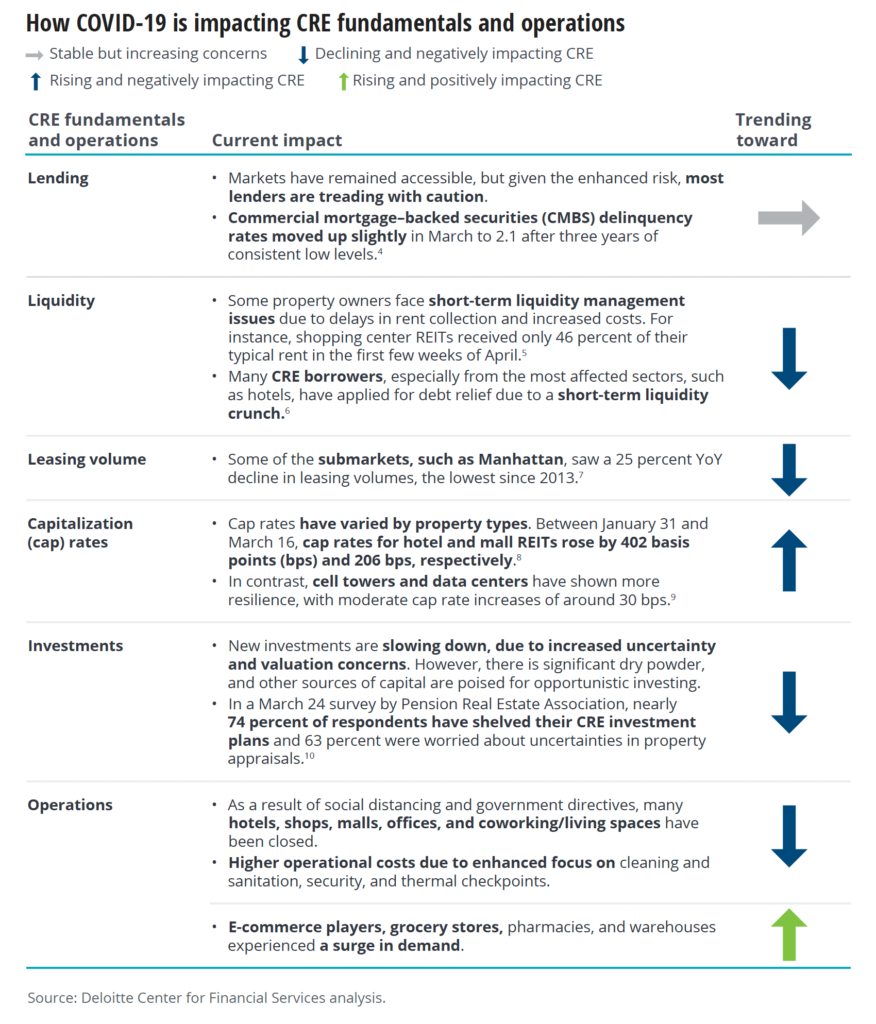

On the one hand, we are facing a global situation where uncertainty in the economy is at an all-time high with growth expectations altered, sometimes drastically, by the pandemic. On the other hand, the real estate market was in the fortunate position of being fundamentally strong – pre-COVID-19. [2] Reports on sales for April 2020 have so far indicated a significant drop in the number of sales – hardly surprising, given the challenges of marketing property without open houses and largely reliant on virtual viewings – but, so far, very little movement in price, which is also encouraging for sellers in the short term. For the immediate future, prioritizing safety, protecting tenants, liquidity needs, and remote working will be main considerations for real estate professionals. [3]

JLL predicts a sharp contraction of the North American economy in Q2, possibly into Q3, but anticipates stabilizing by the end of the year. [4] Further activity, in the second half of 2020, could reflect a move towards a buyers’ market, which would be favorable for investors and first-time home buyers alike. With the hospitality industry being severely affected for the coming summer, and owners who currently operate investment properties as Airbnbs finding their income for the year all but vanished, it is reasonable to anticipate a significant increase in the number of properties coming on to the market. The third quarter of the year could provide an excellent opportunity for investors, enabling them to ‘buy low’ and either benefit from rental income or ‘sell high’ at a later date.

For homeowners, the situation will largely depend on their personal circumstances. If they are in a position where they have to sell, it may be better to do so fairly quickly while sales are still attracting prices close to pre-COVID levels. Alternatively, people who intend on staying in their current property for the foreseeable future, and who are still working, or getting financial help with wage losses, should not be greatly affected – if their home is just that, a roof over their heads rather than a source of income, they will be able to hold on until the market recovers.

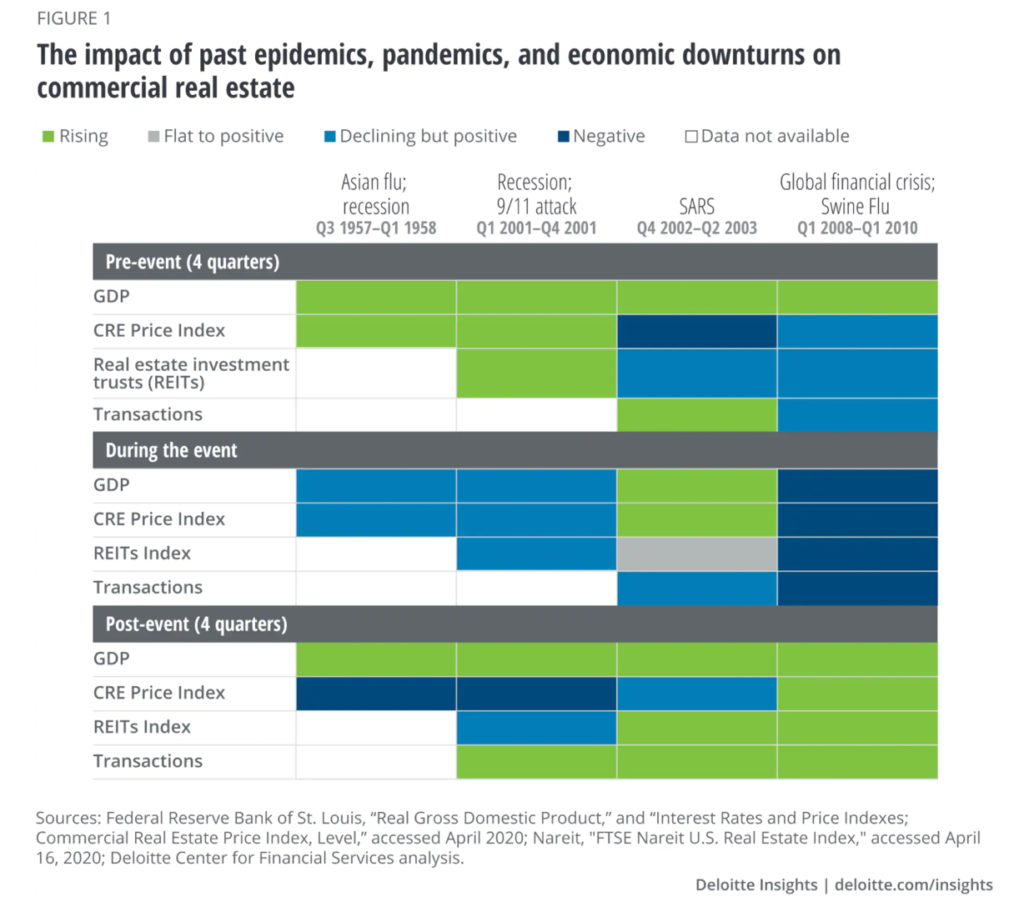

Going forward, real estate remains an excellent long-term investment. If homeowners and investors are in a position to ride out the current downturn, then they should see prices bounce back within a couple of years. Some regions might see a slightly longer recovery period, but history shows us that recovery will eventually happen.

[1] www.us.jll.com Coronavirus real estate implications: JLL Research and Strategy

[2] www2.deloitte.com Understanding Covid-19’s impact on the real estate sector: Kathy Feucht, Global real estate leader

[3] www2.deloitte.com Understanding Covid-19’s impact on the real estate sector: Kathy Feucht, Global real estate leader

[4] www.us.jll.com Coronavirus real estate implications: JLL Research and Strategy